Life Insurance in and around Colorado Spgs

Life goes on. State Farm can help cover it

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

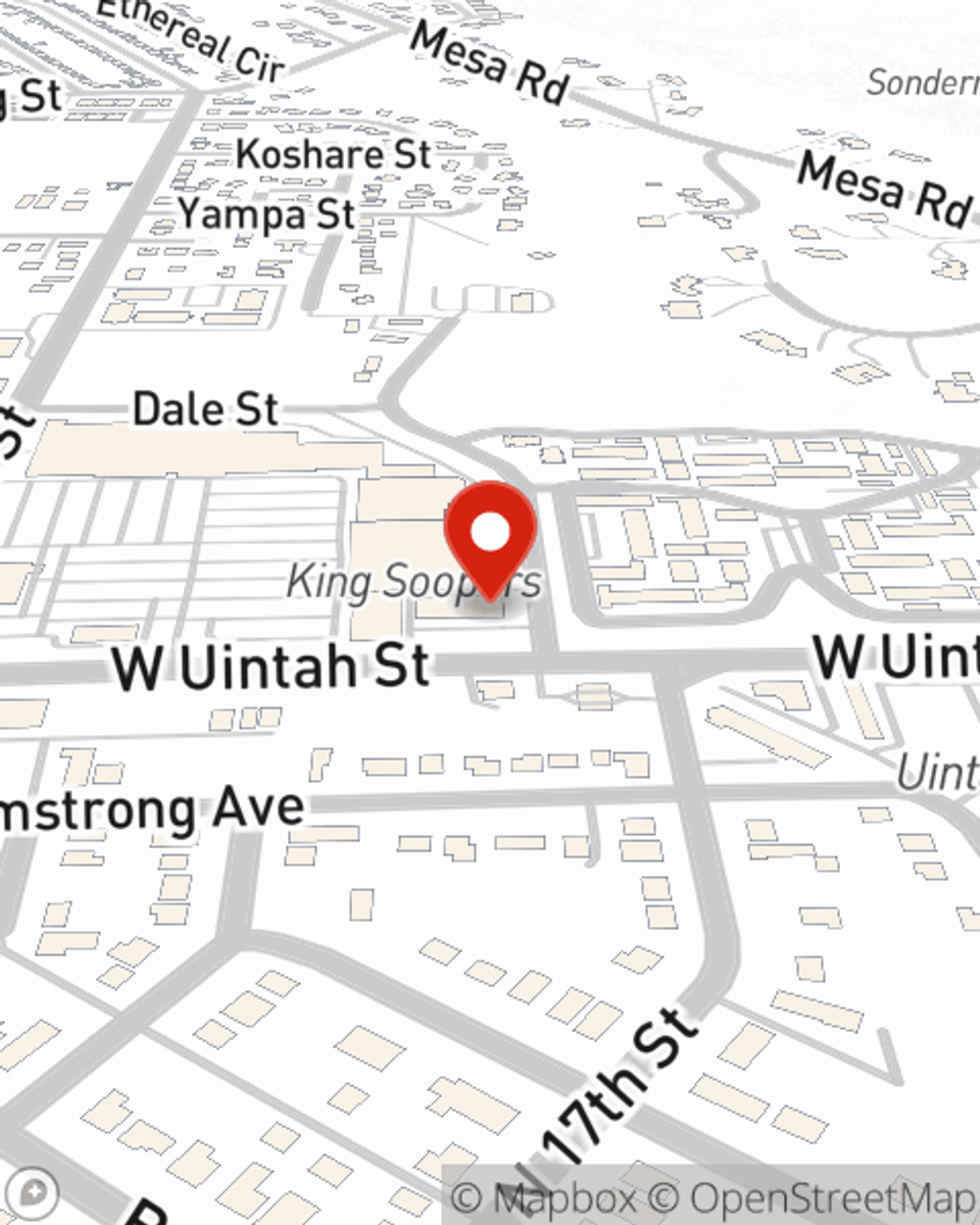

- Colorado Springs

- Woodland Park

- Fountain

- Falcon

- Castle Rock

- Security

- Widefield

- Black Forest

- Green Mountain Falls

- Crystola

- Chipita Park

- Cascade

- Monument

- Fort Carson

- Schriever A.F.B

- Manitou Springs

- Palmer Lake

Your Life Insurance Search Is Over

Choosing life insurance coverage can be a lot to think about with a variety of options out there, but with State Farm, you can be sure to receive dependable compassionate service. State Farm understands that your goal is to protect the people you're closest to.

Life goes on. State Farm can help cover it

Life won't wait. Neither should you.

Why Colorado Spgs Chooses State Farm

When deciding on your Life insurance coverage, it's helpful to know the factors that play into the type and amount of Life insurance you need. These tend to be things like how old you are, your physical health, and perhaps even occupation and lifestyle. With State Farm agent Sean Oram, you can be sure to get personalized service depending on your unique situation and needs.

It's always a good idea to make sure your loved ones have coverage against the unexpected. Reach out to Sean Oram's office to check out your Life insurance options with State Farm.

Have More Questions About Life Insurance?

Call Sean at (719) 235-5017 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Tips for managing life insurance after divorce

Tips for managing life insurance after divorce

Not sure how a divorce will affect your life insurance policy? Consider these tips for managing your insurance policies after divorce.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.

Simple Insights®

Tips for managing life insurance after divorce

Tips for managing life insurance after divorce

Not sure how a divorce will affect your life insurance policy? Consider these tips for managing your insurance policies after divorce.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.