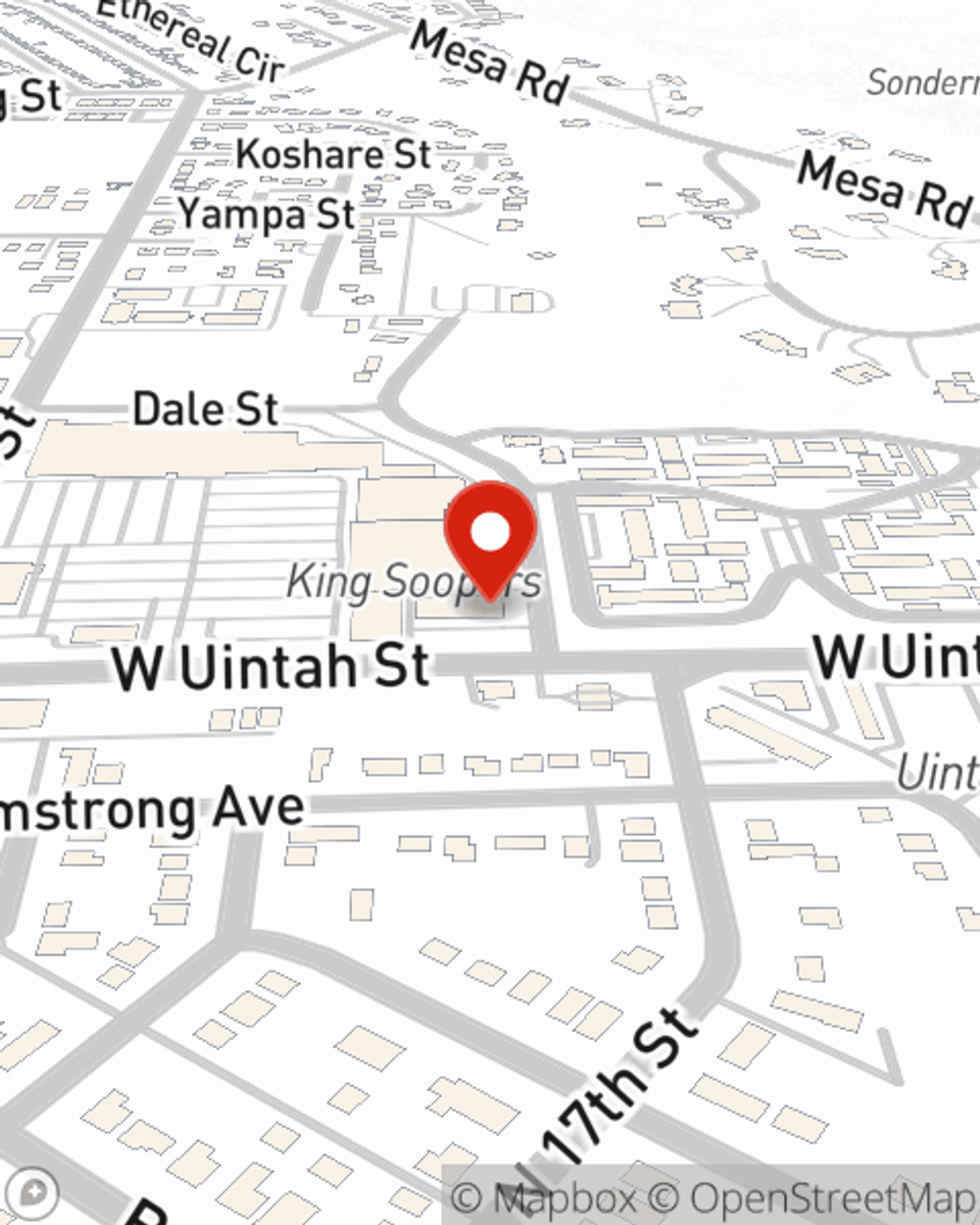

Life Insurance in and around Colorado Spgs

Coverage for your loved ones' sake

What are you waiting for?

Would you like to create a personalized life quote?

- Colorado Springs

- Woodland Park

- Fountain

- Falcon

- Castle Rock

- Security

- Widefield

- Black Forest

- Green Mountain Falls

- Crystola

- Chipita Park

- Cascade

- Monument

- Fort Carson

- Schriever A.F.B

- Manitou Springs

- Palmer Lake

It's Never Too Soon For Life Insurance

It can be a big responsibility to take care of the people you love, which may include finding the right Life insurance coverage. With a policy from State Farm, you can help ensure that those closest to you can pay off debts and/or keep paying for your home as they grieve your loss.

Coverage for your loved ones' sake

What are you waiting for?

Life Insurance Options To Fit Your Needs

And State Farm Agent Sean Oram is ready to help design a policy to meet you specific needs, whether you want coverage for a specific time frame or level or flexible payments with coverage designed to last a lifetime. Whichever one you choose, life insurance from State Farm will be there to help your loved ones keeping going, even when you can't be there.

Interested in exploring what State Farm can do for you? Get in touch with agent Sean Oram today to get to know your unique Life insurance options.

Have More Questions About Life Insurance?

Call Sean at (719) 235-5017 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Tips for managing life insurance after divorce

Tips for managing life insurance after divorce

Not sure how a divorce will affect your life insurance policy? Consider these tips for managing your insurance policies after divorce.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.

Simple Insights®

Tips for managing life insurance after divorce

Tips for managing life insurance after divorce

Not sure how a divorce will affect your life insurance policy? Consider these tips for managing your insurance policies after divorce.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.